ETH Price Prediction: Analyzing the Path to $5,400 and Beyond

#ETH

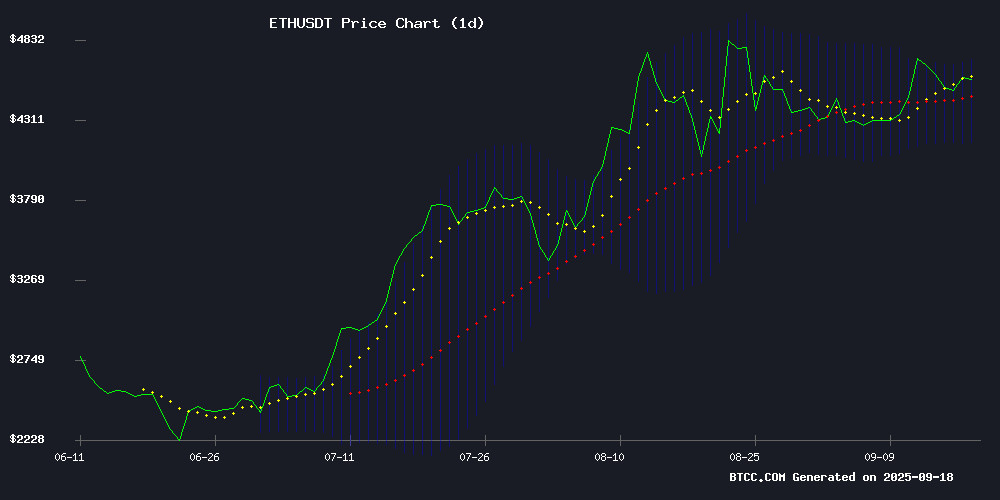

- Technical indicators show ETH trading above key moving average with bullish momentum building

- Institutional adoption through American Express and Grayscale signals growing mainstream acceptance

- MACD convergence and Bollinger Band positioning suggest potential breakout toward $5,400+ targets

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

Ethereum is currently trading at $4,604.21, positioned above its 20-day moving average of $4,433.44, indicating underlying strength. According to BTCC financial analyst William, 'The price holding above the moving average while MACD remains negative suggests consolidation before potential upward movement. The Bollinger Band configuration with current price NEAR the upper band at $4,707.07 shows healthy volatility with room for expansion.'

Market Sentiment: Institutional Adoption and Technical Breakout Potential

Positive developments including American Express's ethereum integration and Grayscale's staking move are creating bullish sentiment. BTCC financial analyst William notes, 'The combination of institutional adoption and technical indicators approaching key resistance levels suggests growing confidence. While short-term profit-taking may cause volatility, the fundamental narrative remains strongly supportive of higher price targets.'

Factors Influencing ETH's Price

Buterin Defends Ethereum's 43-Day Unstaking Delay Amid Liquidity Concerns

Vitalik Buterin has publicly justified Ethereum's 43-day unstaking delay as 2.49 million ETH remains trapped in the exit queue. The ethereum co-founder framed staking as a "solemn duty" comparable to military service, where withdrawal friction is intentional. This stance clashes with growing criticism from developers who argue the lengthy process harms retail users needing liquidity.

ValidatorQueue data reveals 35.6 million ETH currently staked across 1 million validators earning 2.87% APR. Developer Robert Sags highlighted the disconnect between marketing staking as "easy yield" and the reality of unpredictable delays, particularly for users needing funds for urgent expenses. The debate underscores Ethereum's balancing act between network security and user experience demands.

American Express Quietly Integrates Ethereum Blockchain in New Travel App

American Express has introduced blockchain technology through the back door of its new travel app. The financial services giant embedded Ethereum-based NFT stamps in its AmEx Passport feature, creating digital mementos for cardholders' travels. These non-transferable tokens serve as modern replacements for passport stamps - a nod to nostalgia in an increasingly paperless world.

The implementation reflects a growing trend of institutional adoption without fanfare. AmEx deliberately downplayed the Web3 elements, focusing marketing on user experience rather than technological underpinnings. VP Colin Marlowe confirmed the stamps are valueless NFTs on Ethereum's blockchain, designed solely as digital keepsakes tied to travel purchases.

This stealth integration suggests corporations are testing blockchain applications where the technology solves specific problems invisibly. The approach contrasts with crypto-native companies that flaunt blockchain as a selling point. AmEx's strategy indicates enterprise adoption may advance through utility rather than ideology.

Grayscale's Ethereum Staking Move Signals Institutional Shift

Ether surged past $4,600 amid signs Grayscale Investments may begin staking its substantial holdings. The digital asset manager moved 40,000 ETH in precise 3,200-coin batches to unidentified wallets—a potential precursor to validator activation.

Grayscale's 1.5 million ETH reserve could generate 45,000-60,000 tokens annually through staking. Such a move would instantly make the firm one of Ethereum's largest validators, requiring deployment of 45,785 nodes. The strategy mirrors growing institutional demand for crypto yield products following BlackRock's push for staking-enabled ETFs.

The company's Ethereum accumulation dates back to purchases at $90 per token. While Grayscale liquidated portions over time, its remaining position—bolstered by inflows to its spot ETH ETF—represents one of crypto's most influential dormant stakes now potentially entering active validation.

ETHSofia 2025 Gathers Blockchain Innovators for Premier Balkan Crypto Event

ETHSofia Conference and Workshops returns to Sofia Tech Park on September 24-25, 2025, solidifying its position as the Balkans' flagship crypto gathering. The event will assemble 70+ speakers including Bitget's Vugar Usi Zade, Consensys' Stefan Bratanov, and Ledger co-founder Nicolas Bacca to dissect web3's evolving landscape.

Bulgaria's Financial Supervision Commission will address MiCA regulation implementation, marking a pivotal moment for regional compliance with EU standards. Interactive workshops hosted by Sui, J.labs, and others offer developers hands-on learning with competitive bounties.

Ethereum Whales Approach Critical Profit-Taking Threshold as Resistance Holds

Ethereum's mid-sized whales are sitting on unrealized gains reminiscent of November 2021's all-time high, with wallets holding 10,000-100,000 ETH now facing a critical profit-taking decision point. The cryptocurrency has demonstrated resilience above $4,500 but struggles to breach the $4,750 resistance level—a technical threshold that could determine near-term price direction.

CryptoQuant data reveals these whale cohorts now hold paper profits comparable to peak cycle conditions. Market structure remains bullish, yet the convergence of technical resistance and historic profit-taking patterns suggests heightened volatility risk. A decisive break above $4,750 could propel ETH toward new highs, while rejection may trigger cascading sell orders from profit-sensitive holders.

Ethereum Price Flashes New $5,400+ Target As Key Metric Drops To 6-Month Low

Ethereum charts reveal a bullish 'cup and handle' formation, signaling a potential breakout toward $5,430. On-chain data underscores the momentum, with selling pressure plunging to a six-month low. The Spent Coins Age Band metric shows only 42,700 ETH moved for sale—an 83.5% drop since mid-September.

NUPL and exchange FLOW metrics corroborate the trend, with fewer wallets realizing profits and reduced ETH deposits to exchanges. This convergence of technical and on-chain factors suggests accumulation by holders, creating a supply squeeze that could amplify upward price movement.

Ethereum Gears Up For $10,000: Charts Flash Parabolic Rally Signals

Ethereum is entering a critical phase that could propel its value into five-figure territory, according to a multi-timeframe analysis by trader Cantonese Cat. The cryptocurrency has breached key resistance levels, with technical indicators across monthly, weekly, and daily charts suggesting a potential surge to $7,752, $9,883, or even $14,011.

The monthly chart reveals a decisive breakout above the 0.886 Fibonacci retracement NEAR $4,000—a level that previously stifled upward momentum. This breakthrough, coupled with expanding Bollinger Bands and impulsive price action, signals trend acceleration rather than a pullback. The wick of the latest push has already surpassed the November 2021 peak, indicating dwindling supply at historic highs.

Ethereum Treasury Firm The Ether Machine Files for US Public Listing via SPAC Merger

The Ether Machine, a major Ethereum treasury holder, has taken concrete steps toward a US public listing by confidentially submitting a draft S-4 registration with the SEC. The filing relates to its planned merger with special-purpose acquisition company Dynamix Corporation, initially announced in July 2025.

Upon completion of the deal—expected in Q4 2025 pending approvals—the combined entity will trade under the ticker ETHM. The company has engaged a Big Four auditor to prepare for public market scrutiny, signaling institutional-grade financial reporting standards for its $2.16 billion ETH holdings.

With 495,362 ETH in reserve and $367 million earmarked for additional purchases, The Ether Machine's MOVE represents one of the largest attempts to bring crypto-native treasury assets onto regulated exchanges. The SPAC route mirrors strategies used by crypto miners during the 2021 bull market, now adapted for Ethereum's institutional adoption phase.

Ethereum Nears Local Bottom as Binance Open Interest Declines

Ethereum appears poised for a rebound after failing to breach its $5,000 all-time high in August 2025. A notable drop in Binance's ETH open interest suggests the asset may have found a local bottom, historically a precursor to upward momentum.

Analyst burakkesmeci highlights a consistent pattern: Ethereum's open interest declines by an average of 14.9% before forming local bottoms, with spot prices typically correcting 10.7%. Recent data shows OI drops of 10.52% on August 17, 25.38% on August 20, and most recently from $11.39 billion to $10.4 billion on September 13.

The relationship between futures activity and spot prices remains crucial. Healthy rallies occur when futures support spot price movements—a dynamic now being closely watched as Ethereum consolidates near key levels.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a compelling investment opportunity. The price above the 20-day MA combined with growing institutional adoption creates a favorable risk-reward scenario. However, investors should monitor the MACD convergence and Bollinger Band dynamics for optimal entry points.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,604.21 | Neutral/Bullish |

| 20-day MA | $4,433.44 | Support |

| MACD | -40.08 | Converging |

| Bollinger Upper | $4,707.07 | Resistance |